Advertisement

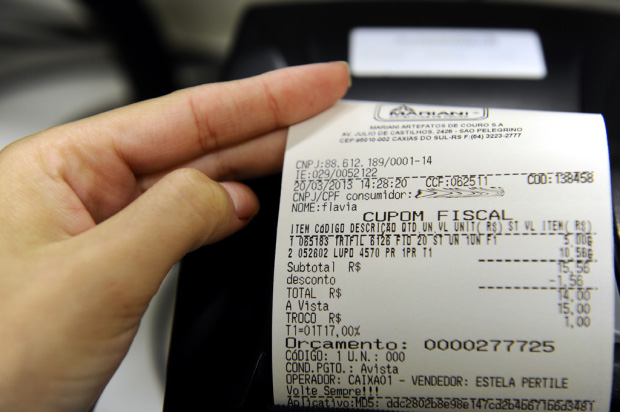

The practice of including your CPF number on your invoice when making purchases is a simple action that can bring several benefits, including the possibility of winning cash prizes. This habit, promoted by initiatives such as Nota Fiscal Paulista and similar programs in other Brazilian states, aims to encourage fiscal citizenship and combat tax evasion.

What is the Nota Fiscal with CPF?

The inclusion of the CPF in the Nota Fiscal is a measure implemented by several Brazilian states to encourage consumers to demand the tax document for their purchases. Programs such as Nota Fiscal Paulista, Nota Fiscal Carioca, Nota Fiscal Gaúcha, among others, offer consumers the opportunity to participate in raffles and receive a portion of the taxes collected back.

Advertisement

By including the CPF on the invoice, the consumer ensures that the transaction is officially registered, helping to combat tax evasion. These programs usually distribute monthly prizes that can range from small amounts to significant sums, as well as credits that can be redeemed or used to write off taxes, such as IPVA.

Benefits of Including the CPF on the Invoice

1. Participation in draws

One of the main attractions of these programs is participation in prize draws. The prizes can be very attractive, ranging from small amounts of money to larger prizes such as cars and sums of hundreds of thousands of reais. The draws are usually monthly, and each invoice with CPF entitles you to a number to enter.

Advertisement

2. Receiving Credits

In addition to the prize draws, the inclusion of the CPF on the invoice allows consumers to accumulate credits. These credits are a percentage of the amount of tax collected by the company, and can be redeemed for cash or used to offset taxes, such as IPVA. In some states, it is possible to transfer these credits to a checking or savings account.

3. Combating tax evasion

By requesting an invoice with CPF, consumers help to ensure that the commercial transaction is duly registered. This combats tax evasion, a practice that harms tax collection and, consequently, investment in public services such as health, education and security.

4. Financial control

Requesting the invoice and including the CPF can also help control personal finances. Many programs provide a detailed statement of purchases made, allowing consumers to track their spending and better manage their budget.

How to take part?

Participating in these programs is quite simple. Here's how:

- Registration: The first step is to register on your state's program website. Registration is usually quick and requires basic information such as name, CPF, address and contact details.

- Request the CPF on the invoice: When you make a purchase, ask the clerk to include your CPF on the invoice. In establishments that are already used to this practice, this request is made automatically when you inform them that you want the CPF on the invoice.

- Tracking: After making your purchases, you can keep track of your invoices on the program's website. Some programs also offer mobile applications that make this tracking easier.

- Participation in draws and redemption of credits: With registered invoices, you automatically participate in the monthly draws. In addition, accumulated credits can be redeemed according to the rules of your state's program.

Examples of programs in Brazil

- Nota Fiscal Paulista: Program run by the state of São Paulo, one of the best known and most widely used. It offers monthly prize draws and allows credits to be used to pay off the IPVA tax.

- NF Carioca: Rio de Janeiro's program, which also offers raffles and the possibility of redeeming credits.

- Nota Fiscal Gaúcha: Rio Grande do Sul's program, with monthly draws and benefits for social institutions.

Each state has its own rules and benefits, so it's important to find out about the specific program in your region.

A practice that brings benefits

Including the CPF number on invoices is a practice that brings benefits to both consumers and society as a whole. In addition to the possibility of winning cash prizes and accumulating credits that can be redeemed or used to reduce taxes, this practice contributes significantly to the fight against tax evasion, promoting greater tax collection and, consequently, investments in public services.

Adopting this measure on a daily basis is simple and can bring considerable rewards. So the next time you make a purchase, don't forget to ask for your CPF to be included on the invoice. Who knows, maybe you'll be the next to win a great prize?

See also: Investing in Shares: 15 Tips for Beginners

June 2nd, 2024

Graduated in Languages - Portuguese/English, creator of Escritora de Sucesso, she also writes for Credittcards, expanding the knowledge of those looking to invest and take care of their finances, through tips and the main news from the universe in question.