Advertisement

O Next is a digital bank that has been gaining ground among users looking for practicality and savings in banking services. But as security is one of the main concerns when dealing with money, many people wonder: is Next a safe bank? Here's all the information you need to know about the bank's security and make an informed decision.

What is Banco Next?

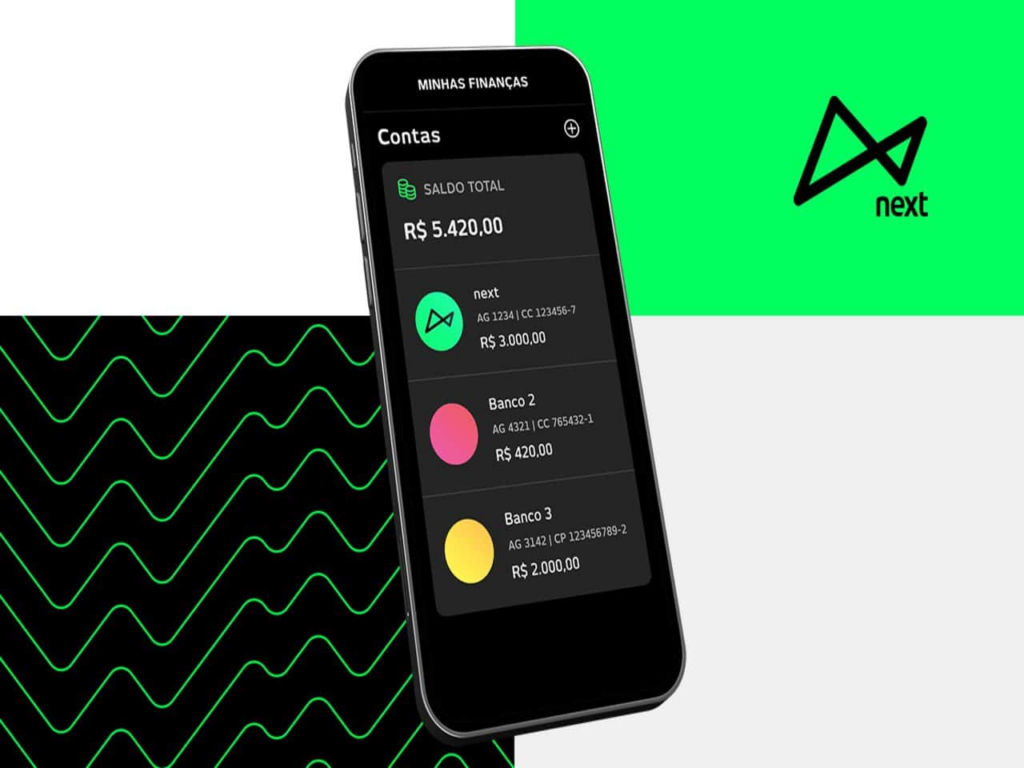

Next is a financial services platform created by Bradescois one of the largest and most traditional banks in Brazil. It was born with the proposal of being a totally digital bank, offering free accounts, credit cards and various other services directly through the app.

Advertisement

As it is linked to Bradesco, Next carries the credibility of a consolidated institution in the financial market. In addition, it is regulated by the same standards as traditional banks, which is already an indication of security.

How does security work at Next?

To guarantee the protection of its customers' data and money, Next adopts a number of digital security measures and good banking practices. Below are some of the main resources the bank uses to protect its users.

Advertisement

1# Data protection and encryption

Next uses end-to-end encryption in all transactions, ensuring that the information exchanged between the application and the server is protected against unauthorized access.

2# Two-factor authentication (2FA)

Next requires two-factor authentication for sensitive operations such as transfers and payments, increasing account protection against fraud.

3# 24/7 monitoring

Next's system performs continuous transaction monitoring to identify suspicious activity in real time. If any unusual activity is detected, the bank can temporarily block the account to prevent losses.

4# Regulation by the Central Bank

Like any other financial institution, Next is supervised by the Central Bank of BrazilThis ensures that it follows all the regulations required of banks in the country.

5# Credit card security

Next's cards include contactless payment technology and direct control via the app, where you can block and unblock the card at any time. This gives you greater peace of mind in the event of loss or theft.

What guarantees does Next offer?

Next's customers have the same protection offered to users of other traditional banks. This includes Credit Guarantee Fund (FGC)This guarantees a refund of up to R$ 250,000 per CPF in the event of bank failure.

In addition, as it is a digital extension of Bradesco, customers can count on the support and infrastructure of this institution, which adds more security and trust.

How to avoid fraud when using Next?

Although the bank offers robust security measures, it is essential that the customer also adopts good practices to avoid fraud. Here are some tips to keep your account safe:

- Don't share passwords or authentication codes with third parties.

- Avoid accessing your account on public Wi-Fi networksbecause they are more vulnerable to invasions.

- Enable two-factor authentication to increase security.

- Keep the application up to dateensuring that you have the most secure versions available.

These measures help to reduce risks and ensure that your money and personal information remain protected.

Is Next safe for you?

With all the security measures offered and regulation by the Central Bank, Next can be considered a safe bank. Bradesco's partnership and infrastructure reinforce this confidence, ensuring that the digital bank operates with standards of quality and protection comparable to those of traditional banks.

In addition, the use of encryption, two-factor authentication and continuous monitoring shows that Next is in line with the best digital security practices. However, it is essential that the customer also does their part by using the app responsibly and adopting basic precautions.

A practical and safe choice

If you're looking for practical banking services without sacrificing security, Next is a good option. The combination of advanced technology, data protection and the FGC guarantee makes it a reliable bank for those who want to carry out financial transactions quickly and safely.

With Next, you can manage your account and your investments in a practical way, directly from your cell phone, with the confidence that your security is being treated seriously.

See also: What is the cheapest loan for MEI? See the best options

October 22nd, 2024

Graduated in Languages - Portuguese/English, creator of Escritora de Sucesso, she also writes for Credittcards, expanding the knowledge of those looking to invest and take care of their finances, through tips and the main news from the universe in question.